In 1971, the world’s financial system changed. Nixon took the US dollar off the gold standard.

Today, the world’s financial system is changing again. Foreign central bank holdings of U.S. Treasuries (U.S. government debt) have fallen from their peak of $7.6 trillion in 2021–22 to about $3.8 trillion in 2025 — almost half. At the same time, foreign central banks have added several thousand tonnes to their gold reserves. Combined with the surge in gold’s price, this means that, for the first time in decades, foreign central banks now own more gold than U.S. government debt.

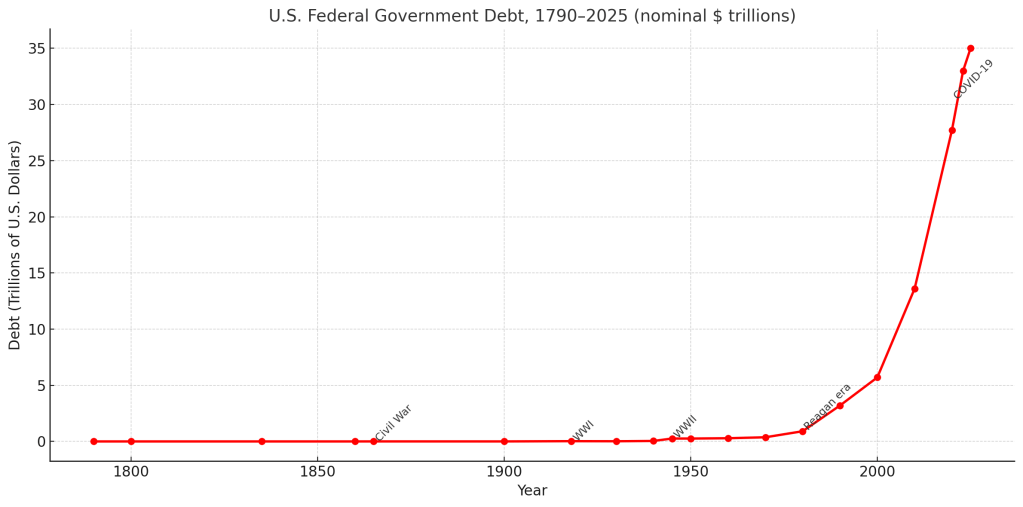

This suggests that the rest of the world is waking up to the reality that U.S. government debt is unsustainable and that holders may not be repaid in full. It seems safer to own something that doesn’t depend on the behaviour of a government addicted to debt.

The questions you have to ask yourself — and then research and learn the answers to — are:

- Is it possible for the U.S. government to turn itself around, given its massive interest payments, gargantuan military spending, and a Social Security system projected to run out of money by 2034?

- If the internet (and now AI) has changed everything, does it really make sense for the world’s financial system to return to a gold standard—where people, companies, banks, and governments hold gold reserves—or are we more likely to see a new digital money emerge?

- Are there any realistic contenders, other than Bitcoin, that can compete with the gold-like certainty of unchangeable rules that govern the network?